Originally published at The 405

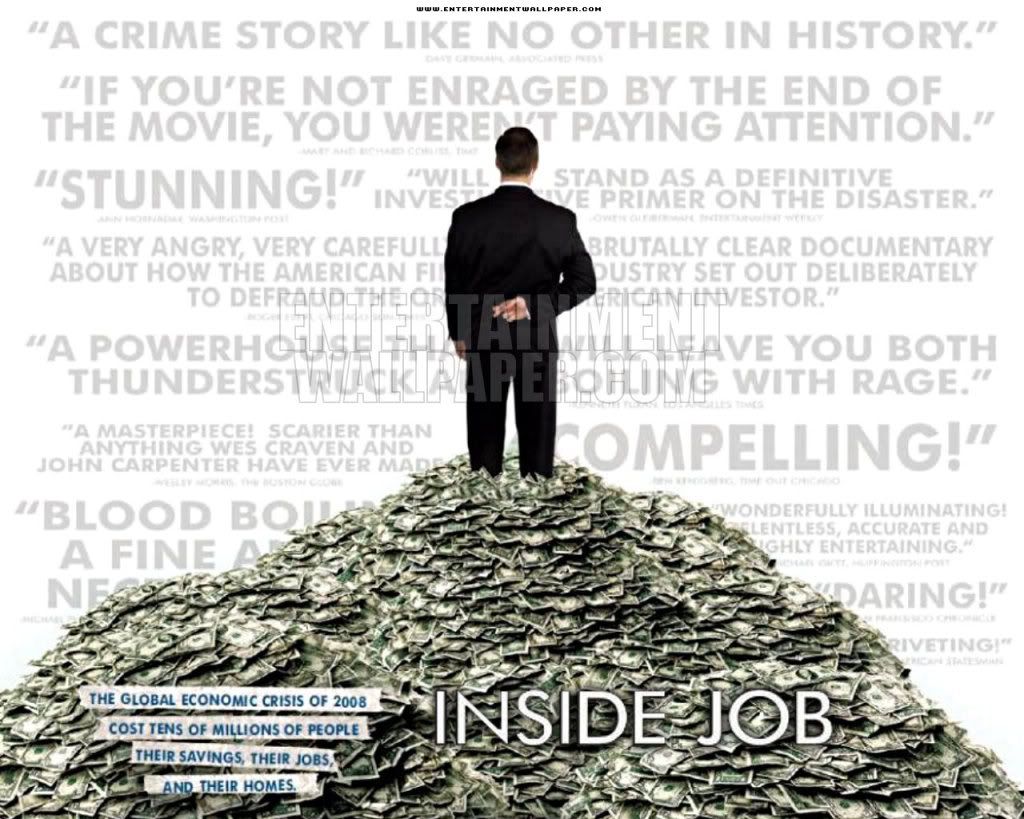

Directed by: Charles Ferguson

Releases: 18/02/11

Starring: Matt Damon, William Ackman and Daniel Alpert

Inside Job is Charles Ferguson's ambitious attempt to expose the systemic defects that led to the Great Recession. It's greatest success is in stirring up anger and horror at the sheer audacity of some of the architects of the crisis, who were actually willing to comment on the record under Ferguson's interrogations. However, I'm not as convinced it worked as a useful analytical framework to truly understand what went wrong before 2008.

The movie was very effective in describing the individual pieces of the puzzle such as deregulation, credit default swaps, derivatives, basic human greed (by both the banks and by the average Joe, obsessed with keeping up with the Joneses) and so on. It was less effective in explaining how these pieces came together to create a systemic meltdown. There was almost no mention of Fannie Mae and Freddie Mac, and how they became embroiled in this mess. I suspect that the problem is that the story is way too complex to adequately cover in a two-hour mainstream release, but it's a real shame given the complicity of so many people that Ferguson managed to interview.

There are wonderful 'oh the wisdom of hindsight' interviews with Christine Lagarde (French Finance Minister) and Dominique Strauss-Kahn (IMF). There are also fantastic moments where Ferguson catches Bush toadies, cloaked in self-righteousness, contradicting themselves within 5 minute spans. You can see some of them actually begin to sweat.

That said, there is no doubt that these people screwed up enormously; what's still unclear is why. Ferguson had the opportunity to interrogate why they acted as they did. Apart from the Goldman-Sachs short-sellers, the industry as a whole cannot have been rooting for failure. What peculiarity in ideology led to this mess?

Also, Inside Job commits what I call the "Fahrenheit 9/11 sin": it made a specious argument about 'mentality' in the place of a useful analysis of systemic lock-in of mentality. The movie kept turning back to the 'prostitutes and cocaine' culture of 1980s Wall Street as an explanation for the hubris and greed driving the thirst for deregulation and increased amount of risk. This strangely Puritanical focus confuses personality with decision making; if there's a connection to be made between these men's retrograde attitudes towards women and their poor decision making at the office, than Inside Job doesn't make it convincingly.

The movie became much more effective and coherent when it turned a sharp lens on the conflict of interest between academia and consulting work. A full third of the movie is devoted to exposing the hypocrisy of the men who were paid to write highly prejudiced op-ed pieces on behalf of business institutions even as they were meant to be teaching the next generation the ethics of business.

There were a lot of moving pieces leading to the financial crisis; the unfortunate truth is that there wasn't any one piece that broke, everything broke at the same time. Inside Job's greatest strength is in identifying and describing the disparate forces at work that led to this disaster; perhaps, in a sequel, Ferguson can give us more insight into why they failed.